Debt

Please note that there are various ways to help you manage your debts and you need to be aware that there is a cost implication to most of them. It is crucial that you seek advice on the best option for you and your particular circumstances.

- What are the powers of bailiffs and debt collectors?

-

- Bailiffs are employed by creditors to collect debts owed to them and may seize your goods as a form of payment. Creditors may at some stage use bailiffs to attempt to seize property to be sold to repay debts owed. Generally they cannot do this without permission from the Court. The Magistrates court will grant permission for the use of bailiffs for debts such as Council Tax or Fines whereas the County or Civil Court will issue warrants in relation to unsecured, consumer debts.

- There are several types of Bailiffs that may be instructed depending on the type of debt and who it is owed to. In most cases a bailiff would either be a Certificated Court Officer or be employed by a Private Firm that have been asked to collect the debt.

- Bailiffs cannot enter your property by force unless they have been let in on a previous visit to collect the same debt. You should, therefore, consider refusing to let the bailiff into your home. This will ensure that they cannot force entry if they visit again.

- If you let a bailiff into your home, they will usually ask you to sign a walking possession agreement and leave goods on your premises as long as you make payments as they demand.

- Bailiffs cannot seize your basic household goods, clothing, bedding and tools of the trade. They are not allowed to seize goods belonging to a person other than the debtor but can normally seize jointly owned goods. The proceeds of any sale of jointly owned goods would have to be divided between the owners.

- Debt collectors are not bailiffs and do not have the same range of powers. They must not harass people who owe money, but they are allowed to pursue debts by letter, phone, and in extreme cases legal action. They are also allowed to petition for bankruptcy.

- My creditors keep calling me. What can I do?

-

- People you owe money to are called creditors. Both creditors and collection agents use letters and telephone calls to recover debts as an alternative to court action. Most creditors have limited powers to recover a debt unless court action has been taken against you and you have not paid as ordered by the court. Some creditors may mention that they can make you bankrupt for debts of £750 or over. It is very rare for a creditor to take this action.

- If you receive telephone calls from your creditors, it is important to explain that you are having financial difficulties and how you hope to resolve the situation. If you have done this and you are still receiving persistent calls from your creditors or their collectors, this may count as harassment.

- Creditors should not put undue pressure on you to pay more than you can afford. Office of Fair Trading guidelines state that, for example, creditors should not:

- contact you by telephone too frequently;

- pressure you into selling any of your property or assets; or

- pressure you into taking on further debt to repay existing debts.

- If your creditor is not following these guidelines then you should keep a note of calls from your creditor including the date and time as well as the name of the person you are speaking to. You should also keep a copy of all letters. This information can then be used to complain to the Office of Fair Trading or your local Trading Standards Office.

- What is involved in going bankrupt?

-

- Bankruptcy is an option you can take when you have debts that you cannot afford to pay.

- In bankruptcy the Court appoints someone to take over the management of your financial affairs. The person is usually called the Trustee.

- You can be made bankrupt by your creditors. Alternatively you can petition for your own bankruptcy, but in both cases you must owe more than £750. If you owe less than £5,000 other options are likely to be more appropriate.

- Advantages of bankruptcy include:

- most creditors have to stop chasing you for the debt and make their claim to the trustee instead;

- it’s a chance to make a fresh start.

- There are some disadvantages to bankruptcy:

- You may lose certain assets – but your basic household goods, clothing and tools of the trade should not be taken.

- Any bank accounts you have will be frozen, although it is normally possible to open a new basic bank account after the bankruptcy order.

- Some of your debts may still be payable at the end of bankruptcy; such as Court fines, maintenance, child support payments and secured loans.

- Bankruptcy may affect your job, your home or your tenancy.

- You may have to make monthly payments to the Trustee. If this happens, you would normally be expected to make payments over three years.

- Bankruptcy is usually worth considering if you have large debts that could not be repaid over a reasonable period of time.

- I have received a County Court Claim form. What do I do now?

-

- Receiving a County Court claim form can seem very worrying, but you can usually deal with the process through the post, without the need for a court hearing.

- If the claim you receive is for money you owe, the forms you use to reply will normally be enclosed with the claim form. It is important to reply within 14 days of receiving the forms.

- If you wish to seek further advice over a possible defence, you should complete the ‘acknowledgement’ form within 14 days, which will extend your time to send back a defence form to 28 days.

- You can reply to the claim in several ways:

- If you feel that the amount owed is correct but you cannot afford to repay the debt in full, you can use the ‘Admission’ form; complete this with your financial details and offer of payment and return it to the ‘claimant’ within 14 days. Don’t offer to pay more than you can really afford.

- If you feel you don’t owe the debt, you can use the ‘Defence and Counterclaim’ form. If you wish to defend the claim, you must send the defence form back to the court.

- If you feel that some of the debt owed is correct but that the rest is incorrect, then you can use both the forms.

- If you have made an offer to pay, but the court has ordered you to pay more than you have offered, you can ask the court to reconsider your offer at a hearing. Any hearing would be at your local county court.

- If you fail to make payments as ordered by court, the claimant can apply for enforcement. This could be by, for example, asking the court bailiffs to visit you; applying for an attachment of earnings order; or asking the court to put a legal charge on any property you own (such as your home).

- Court costs and fees will usually be added to your debt if a judgment is entered against you.

- If a county court judgment is entered against you, this will be registered unless the debt is paid within 28 days of the judgment being made. It will remain on your credit record for six years after the judgment.

- How can I deal with my Council Tax arrears?

-

- Council tax arrears should be dealt with promptly. If you don’t come to an arrangement to pay, your council can take enforcement action against you. This could include, for example:

- getting an amount deducted from wages or certain benefits;

- sending bailiffs;

- applying for a legal charge on any property that you own; or

- making you bankrupt.

- If all else fails, your council can ask the magistrates’ court to consider sending you to prison for non-payment.

Checking the bill -- You could take the following actions to check the amount you owe is correct and possibly reduce the arrears:

- Claim any council tax benefit which you are entitled to. You may be able to get this backdated.

- Claim any exemptions, reductions or discounts which you are entitled to. For example, if you are the only adult in your property, you are normally entitled to a 25% reduction on your bill.

- If your council has passed the debt on to bailiffs then you may still be able to negotiate with the council. They may agree to stop the bailiffs’ action and accept a repayment plan. If they do, you will avoid having to pay bailiffs’ fees.

- You may also be able to negotiate a repayment plan with the bailiffs themselves. However, bailiffs will normally want repayment over quite a short period. Private bailiffs can be very difficult to deal with and it is usually best not to let them into your home. They are not allowed to force entry unless you have let them in on a previous visit.

- If you are having problems negotiating an affordable payment arrangement with your council or bailiffs, you could ask to see any Code of Practice or Recovery Policy with which they should comply.

- As a last resort, your council can ask the magistrates’ court to consider sending you to prison for non-payment. The court may decide instead to either

- set a rate of repayment;

- write off part or all of the debt, depending on your circumstances;

- adjourn; or

- make no order.

- If you are required to attend a committal hearing we recommend you seek specialist advice.

- What are my rights in a Hire Purchase or Conditional Sale Agreement?

-

- A hire purchase or conditional sale agreement means that goods will be hired to you for an agreed period during which you pay instalments. You do not legally own the goods until you’ve paid the last instalment. During the hire purchase agreement the goods belong to the hirer so you must not sell the goods without getting their permission.

- You do have a right to end the agreement early. You can do this by writing to the finance company stating clearly that you want to terminate the agreement. Send your letter by recorded delivery. If you end the agreement early, you must return the goods and you will then normally be liable to pay half the amount due under the agreement, less the payments you have already made.

- If you do not keep up the payments , the hirer is only allowed to repossess the goods if:

- you have given your permission for this to happen;

- the hirer has obtained a court order; or

- you have paid less than a third of the total purchase price and the goods are stored on public land.

- Problems getting credit?

-

- There is actually no such thing as a “blacklist” of people that lenders will automatically refuse to lend to. Most lenders use a combination of information held by the credit reference agencies and their own credit scoring system to decide whether credit should be offered.

- Credit reference agencies hold a record of most credit agreements applied for or taken out. You can obtain a copy of your own credit reference file by applying to one of the three major agencies, which are Experian, Equifax and Call Credit. You will need to supply your name, address, date of birth and all previous addresses for the last six years. The credit reference agencies charge a small fee for this service.

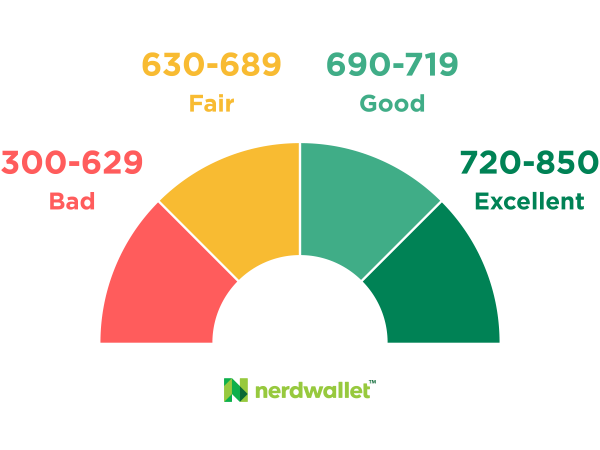

- If you have a credit default or county court judgment registered on your credit file, it will usually remain there for six years, after which it should be removed from your credit file automatically.

- Credit scoring works by allotting points for certain criteria. For example you may get some points for being registered on the electoral roll. The more points you have been allotted, the more likely it is that the credit provider will lend to you. Different creditors have different scoring criteria, so you may be refused by some but accepted by others.

- Where can I go for advice on a business debt problem?

-

- Small businesses and self-employed people can obtain debt advice from www.bdl.org.uk. They have been providing free, impartial and confidential advice for over 20 years.

- How can I make or defend a money claim in the county court?

-

- You can do this online at: www.moneyclaim.gov.uk

- Bailiffs are contacting me about a magistrates court fine. What can I do?

-

- There is an advice tool on Community Legal Services website for advice on this: www.insolvencyhelpline.co.uk

- How does debt affects your credit record?

-

- Information is collected and stored by credit reference agencies and then passed onto lenders, banks, stores when you make an application for credit. Arrangements you make with creditors will show on these records. Your ability to obtain credit may be adversely affected.

- What is bankruptcy?

-

- This is a way of dealing with debts when you cannot afford to pay. Once declared bankrupt, assets could be used to pay off some or all of the debt. After a period of time (usually 1 year), any outstanding debts are written off. However, the effects of bankruptcy are severe so get specialist advice.

- What is an Individual Voluntary Arrangement (IVA)?

-

- A legally binding agreement in the County Court to pay an agreed amount towards your debts over a shorter period of time (60 months). The criteria include: Debts of at least £15,000 to 3 or more separate creditors.

- If you do not keep to an IVA, your creditors can make you bankrupt.

- What is a Debt Relief Order (DRO)?

-

An order granted by the Insolvency Service. The criteria are as follows:

- Qualifying debts of £15,000 or less.

- Assets of less than £300.

- Available income for creditors of £50 per month or less.

- On a low income.

- What is a Debt Management Plan (DMP)?

-

This is an affordable repayment plan set up and managed by a Debt Management Company. They help you work out what amount you can afford, you pay this to the company and they distribute it to your creditors.

You need to answer yes to the following questions:

- Are the debts unsecured?

- Owe more than £5,000 to 2 or more separate creditors?

- Have £100 or more available income each month?

- Can I deal with my debts myself?

-

- You can negotiate with your creditors (people you owe money to) yourself.

- You can work out a budget sheet and then work out a pro-rata amount to pay your creditors each month. You need to pay the priority debts first and then use any remaining available income for your non-priority debts. You can follow the procedures by using the step by step guides available on www.adviceguide.org.uk

- You can also make use of lots of tools and guidance available on the Money Advice Service website.

- How can I manage my budget?

-

- Draw up a budget sheet that lists all the money coming in and all the money you have to pay out.

- Review the budget sheet on a regular basis.

- Shop around for cheapest gas, electricity, phone, insurance deals. Online comparison websites can be useful here.

- Check benefit entitlement to maximise your income here: https://benefits-calculator.turn2us.org.uk/AboutYou

- Avoid credit and loans where possible. Check the terms, including the interest rates, if you are considering borrowing money or using a form of credit.

- Get a financial healthcheck by using www.moneymadeclear.fsa.gov.uk.

- Try to save a regular amount to cover emergencies.

- Do not ignore debts – advice is available online and through specialist debt advice organisations.

- What is a priority debt?

-

Priority debts need to be dealt with first because there can be serious consequences if you do not so e.g. losing your home. They include:

- Rent and mortgage arrears

- Council tax arrears

- Electricity, gas, water bills

- Court fines

- Income tax

- VAT

- TV licence.