Welfare Benefits

The welfare state of the United Kingdom comprises expenditures by local and central government of the United Kingdom intended to improve health, education, employment and social security

- Corona Virus: Businesses

-

- The government wants to ensure businesses are supported to deal with the temporary economic impacts of an outbreak of coronavirus.

- Employers with fewer than 250 employees will be able to reclaim Statutory Sick Pay for employees unable to work because of coronavirus. This refund will be for up to 2 weeks per employee.

- Find out about other government support for businesses.

- Corona Virus : Employees and self-employed people

-

- To make sure people in work can take the necessary time off to stay at home if they are suffering from coronavirus or to prevent its spread, changes have been made to Statutory Sick Pay and how Universal Credit supports self-employed claimants. This includes:

- people who cannot work due to coronavirus and are eligible for Statutory Sick Pay will get it from day one, rather than from the fourth day of their illness – we intend to legislate so this measure applies retrospectively from 13 March 2020;

- Statutory Sick Pay will be payable to people who are staying at home on government advice, not just those who are infected, from 13 March 2020 after regulations were laid on 12 March 2020 – employers are urged to use their discretion about what evidence, if any, they ask for;

- if employees need to provide evidence to their employer that they need to stay at home due to coronavirus, they will be able to get it from the NHS 111 Online instead of having to get a fit note from their doctor – this is currently under development and will be made available soon;

- self-employed claimants on Universal Credit who are required to stay at home or are ill as a result of coronavirus will not have a Minimum Income Floor (an assumed level of income) applied for a period of time while affected.

- Corona Virus: For people who need to make a new claim for financial support

-

- We understand people who are required to stay at home or are infected by coronavirus may need financial support, and quickly.

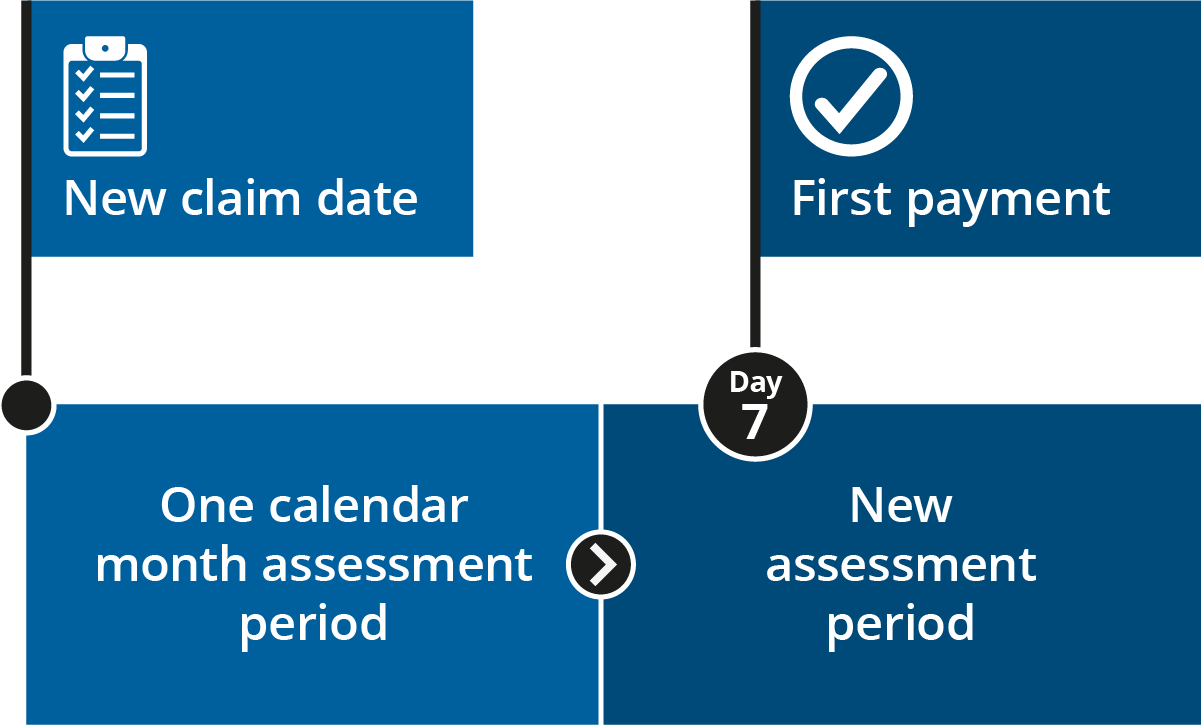

- We announce that: (i) those affected by coronavirus will be able to apply for Universal Credit and can receive up to a month’s advance up front without physically attending a jobcentre, and (ii) the 7 waiting days for ESA for new claimants will not apply if they are suffering from coronavirus or are required to stay at home – so it will be payable from day one

- Corona Virus : For people already claiming support

-

- Special arrangements will be in place for people in receipt of benefits who cannot attend reassessments or jobcentre appointments because they are required to stay at home or are infected by coronavirus. The arrangements are:

- disabled and sick claimants who cannot attend a reassessment for Personal Independence Payment (PIP), Employment and Support Allowance (ESA) or Universal Credit will continue to receive their payments while their assessment is rearranged

- people who need to claim ESA or Universal Credit because of coronavirus will not be required to produce a fit note.

- when claimants tell us in good time that they are staying at home or that they have been diagnosed with coronavirus, they will not be sanctioned – we will review their conditionality requirements in their claimant commitment, to ensure they are reasonable

- claimants who are staying at home as a result of coronavirus will have their mandatory work search and work availability requirements removed to account for a period of sickness

- Waiting for a Universal Credit payment?

-

- If you do not have enough to live on while you wait for your first payment you can ask for an advance payment at your Universal Credit interview or by calling the helpline after you’ve made a claim.

- You can also ask for a hardship payment if you cannot pay for rent, heating, food or hygiene needs because you got a sanction.

- You need to pay it back through your Universal Credit payments - they’ll be lower until you pay it back.

- Our understanding is that it is possible to request an advance payment through the online account. Advance payments will only be granted where DWP consider the Universal Credit claim looks likely to result in an award. The advance payment is a loan from DWP and must be repaid, usually by deducting the agreed repayment amount from subsequent payments of Universal Credit.

- If you’re having financial difficulties or you’re behind on your rent, you or your landlord may be able to apply for an Alternative Payment Arrangement (APA).

- Depending on your circumstances, you could get an APA to: get your rent paid directly to your landlord, get paid more frequently than once a month, receive split payments (if you’re part of a couple). You will need to speak to your work coach to apply for an APA.

- You may be able to get a Budgeting Advance to help with emergency household costs, such as replacing a broken cooker, or for help getting a job or staying in work.

- You’ll repay it through your regular Universal Credit payments - these will be lower until you pay it back. If you stop getting Universal Credit, you’ll have to repay the money in another way.

- The smallest amount you can borrow is £100. You can get up to:

- £348 if you’re single

- £464 if you’re part of a couple

- £812 if you have children

- What you get depends on whether you have savings of over £1,000 and can pay the loan back.

- To get a Budgeting Advance, all of the following must apply:

- you’ve been getting Universal Credit, Employment and Support Allowance, Income Support, Jobseeker’s Allowance or State Pension Credit for 6 months or more, unless you need the money to help you start a new job or stay in work

- you’ve earned less than £2,600 (£3,600 together for couples) in the past 6 months

- you’ve paid off any previous Budgeting Advance loans

- How to apply

- Contact your local Jobcentre Plus work coach to apply.

- Help with housing costs from your local council

- You might be able to get a reduction in your Council Tax.

- You may also be entitled to Discretionary Housing Payments if your Universal Credit payment is not enough to pay your rent.

- I am an EU / EEA national. Can I claim benefits?

-

- The situation is complicated for EEA nationals (nationals of EU member states, as well as Norway, Iceland, Liechtenstein and, for most purposes, Switzerland) and their family members. Even without permanent residence, they have access to benefits if they have a right to reside under EU law. This is a complicated concept, but it covers:

- EEA nationals who are employed or self-employed (as long as the work is “genuine and effective”),

- EEA nationals who are registered jobseekers (although this only gives access to JSA, Child Benefit and Child Tax Credit),

- EEA nationals who are “self-sufficient” (which includes a requirement to buy comprehensive health insurance cover in the UK),

- “Family members” of EEA nationals in one of the above categories (this includes spouses / civil partners, children / grandchildren who are under 21 or still dependent on the EEA national, and parents / grandparents who are dependent on the EEA national).

- It is also possible for EEA nationals who were previously employed to retain their worker status even after stopping work. This applies if they:

- leave work due to pregnancy or childbirth (they can retain worker status for up to a year),

- leave work because of “temporary incapacity” due to illness or disability,

- register as a jobseeker soon after leaving work (the amount of time they can retain worker status depends on the length of time worked),

- start vocational training soon after leaving work (if they left voluntarily, the training must be relevant to their previous employment).

- EEA nationals who were previously self-employed can retain their worker status due to pregnancy / childbirth or temporary incapacity only.

- Note that EEA nationals and family members do not need a right to reside to access Personal Independence Payments (or DLA), Carer’s Allowance, Working Tax Credits or contribution-based benefits.

- Also note that that there are additional restrictions on Croatian nationals until the end of June 2018

- If you’re an EEA national who is a jobseeker in the UK (or their family member), you will not be entitled to Universal Credit (UC) unless you also have a different right to reside as any of the following:

- a worker

- self-employed

- a former worker

- a student

- self-sufficient

- a person who has a permanent right to reside

- I am not an EEA national. Can I claim benefits?

-

- Non-EEA nationals with limited leave to enter the UK (such as visitors, spouses and civil partners) have no recourse to public funds. This includes most benefits, although not contribution-based ones (the full list is here). If this applies to you, make sure to get advice before attempting to claim public funds, as the consequences of doing so when not entitled can be serious.

- What is the local housing allowance / the bedroom tax?

-

- If you are in private rented accommodation, the maximum amount of Housing Benefit you can be paid depends on the number of bedrooms you need and the area where you are renting. You can find the local housing allowance for your area by putting the postcode in here, and you can work out the number of bedrooms you are entitled to here.

- If you are only allowed one bedroom, then you will receive the lower shared accommodation rate if you are living in shared accommodation (which means not having exclusive use of at least two rooms), or if you are single and under 35.

- Note that you will never receive more Housing Benefit than the amount of rent you owe, and the amount will then be reduced if you have more income or savings than are permitted.

- The local housing allowance does not apply to Council and Housing Association properties. Instead, the “removal of the spare room subsidy” or bedroom tax is applied. This means that, if your property has more bedrooms than you are entitled to, your Housing Benefit will be reduced:

- by 14%, if you have one extra bedroom, or

- by 25% if you have two or more extra bedrooms

- This does not apply to people of pension age, and there are a number of ways the bedroom allowance can be increased (such as for a disabled child or carer who needs an additional room). If you think that your bedroom entitlement has been incorrectly calculated, please call us for advice.

- What is the benefit cap?

-

- The benefit cap is a limit imposed on the total weekly benefit a family can receive. This includes Universal Credit and the benefits it is replacing (see above), as well as Child Benefit. It does not include PIPs, DLA, Attendance Allowance, Carer’s Allowance and a few others (see the full list).

- For people living in Greater London (including Ealing Borough), the cap is £442.31 £23,000 pa for couples and single parents, and £296.35 for single people with no children. It is lower in the rest of the country.

- The benefit cap does not apply if you or your partner:

- are not getting Housing Benefit or Universal Credit,

- are working enough to be entitled to Working Tax Credit (or the Universal Credit equivalent),

- are in a nine-month “grace period” after finishing at least a year of work,

- are receiving ESA with the support component (or the Universal Credit equivalent),

- are receiving PIPs, DLA, Attendance Allowance or Carer’s Allowance,

- have reached pensionable age.

What is the two child limit?

- The amount you are paid for various benefits depends on the number of children you have. However, under new rules Child Tax Credit, Housing Benefit and Universal Credit will only be assessed for the first two children. Third (or further) children born on or after 6 April 2017 are not be taken into account, unless they fall into a limited exception (including multiple births or conception by rape).

- Ongoing claims, or claims involving children born before that date, should not be affected. However when making a new claim for Housing Benefit, you will need to show that you are receiving a Child Tax Credit award covering any additional children.

- What is Universal Credit?

-

- Universal Credit is a benefit which replaced the six main means-tested working age benefits:

- Jobseeker’s Allowance (means-tested version),

- Employment & Support Allowance (means-tested version),

- Income Support,

- Working Tax Credit,

- Child Tax Credit,

- Housing Benefit.

- No other benefits will be affected (e.g. Child Benefit, Council Tax Support, Personal Independence Payments, Pension Credits).

- Universal Credit is gradually being phased in (see this document for the latest timetable). Some new applicants will be required to claim Universal Credit, but many existing claimants will continue to fall under the previous system for years to come.

- Please note that JSA and ESA also have “contribution-based” versions (for people who have made enough recent National Insurance contributions), which will continue to exist alongside the new Universal Credit system.

- I am having difficulty with my housing costs. What help is available?

-

- If you are renting, you may be entitled to Housing Benefit, which is administered by the Council. If you claim means-tested JSA, means-tested ESA or Income Support, Housing Benefit can be added onto it (“passported”) automatically, without needing to go through a separate application process.

- If you meet certain conditions, you may be directed to apply for Universal Credit (see below) instead of Housing Benefit (as well as the passporting benefits listed above).

- If you own your home and you receive means-tested JSA, means-tested ESA, Income Support or Pension Credit, you may be entitled to help with mortgage payments as part of the payment.

- In any case, you may be entitled to Council Tax Support, which is also administered by the Council.

- It may be that you find that you need temporary extra help with housing costs. If this is the case, and you receive Housing Benefit and/or Council Tax Support, then it is possible to apply for Discretionary Housing Payments (DHP) or Discretionary Council Tax Discounts (DCTD). These are extra payments that can be made by Council, and because they are discretionary, there is usually no right to appeal a refusal.

- I have children, and I am struggling with money. What help is available?

-

- Parents or guardians responsible for children 16 or younger (20 or younger if in relevant education or training) can claim Child Tax Credit and Child Benefit. Child Tax Credit is means-tested, while Child Benefit is available to any family in which no-one earns more than £60,000 (there will be a charge where someone earns more than £50,000).

- If you are able to claim Working Tax Credit, then as part of it you can get help with childcare costs.

- Single parents of children under 5 who are not in full-time work can claim Income Support (rather than JSA or ESA).

- There are also a number of other programmes to support parents of young children with no or low income.

- If you meet certain conditions, you may be directed to apply for Universal Credit (see below) instead of Tax Credits or Income Support.

- I am pregnant and unable to work. What help is available?

-

- If you are employed and need to take maternity leave to have your baby, you may be entitled to Statutory Maternity Pay (SMP) for 39 weeks. You will qualify if all of the following apply:

- You were employed on the 15th week before the due date.

- You were continuously employed by the same employer for the 26 weeks (six months) leading up to that week.

- You earned at least £113 per week gross (just under 16 hours at minimum wage).

- This is the statutory minimum. It may be that you are entitled to more under your contract, so make sure to check it or ask your employer.

- If you do not satisfy the requirements listed above, you may instead be entitled to Maternity Allowance. This is usually paid by the state for 39 weeks, and you will be entitled if all of the following apply:

- You were employed (including for multiple employers) or self-employed for a total of 26 out of the 66 weeks before your due date (even if there are gaps).

- You earned at least £30 a week in at least 13 of those weeks.

- You are not entitled to Statutory Maternity Pay.

- Note that if you were self-employed and did not pay Class 2 National Insurance payments, then you will be paid Maternity Allowance at a much lower rate. Maternity Allowance is also available (at the lower rate, for 14 weeks only) if you do unpaid work for your self-employed spouse or civil partner.

- If you cannot receive either of the above (or only at a low rate), you are likely to be entitled to Income Support from 11 weeks before your due date (or earlier if your pregnancy makes you incapable of working) until 15 weeks after birth. If you are a lone parent you will continue to be entitled while your child is young (see below). If you meet certain conditions, you may be directed to apply for Universal Credit instead (see below).

- You can apply for a Sure Start Maternity Grant if you receive certain benefits (means-tested JSA or ESA, Income Support, Pension Credit, Child Tax Credit, Working Tax Credit with a disability element, or Universal Credit). The new baby must usually be your only child under 16 (unless it is a multiple birth), and you must apply within three months of the birth. You will need to get a health professional to provide a statement confirming the due date / date of birth.

- I am retired, and I don’t have much money. What help is available?

-

- As well as any private pension, you may be entitled to claim State Pension once you reach the state retirement age. If you are a man born before 6 April 1951 or a woman born before 6 April 1953, this will be the old-style basic state pension and the additional state pension. Otherwise it will be the new state pension.

- Your entitlement is based on the National Insurance contributions you have made across your lifetime. Most people need to have paid contributions for at least 10 years to get any pension, and for 30 years (basic state pension) or 35 years (new state pension) to get the full amount.

- If you are over pension age but cannot get a full state pension or any equivalent income, you may be entitled to Pension Credit, which is a means-tested benefit. You will usually not be entitled to JSA, ESA or Income Support.

- Winter Fuel Allowance is available to people aged 64 or over. It will usually be paid automatically if you are receiving state pension, Pension Credit or certain other benefits.

- I am seriously ill / disabled. What help is available?

-

- There are a number of benefits available to assist people with illness or disability:

- Employment & Support Allowance (ESA) is for people unable to work due to illness or disability. It is the modern version of the old Incapacity Benefit. It acts as a replacement for earnings, and is either contribution-based or means-tested.

- Income Support should be claimed instead of ESA if you are still employed but on long-term sick leave, as it can top up your sick pay.

- If you meet certain conditions, you may be directed to apply for Universal Credit (see below) instead of the above. They cannot usually be combined with Jobseeker’s Allowance, Working Tax Credit or each other, but can be combined with the below:

- Personal Independence Payments (PIPs) are for people under 65 with additional daily living and/or mobility needs as a result of illness or disability. They cover the additional costs due to a person’s condition, and are not means-tested or contribution-based.

- Disability Living Allowance (DLA) is the old version of PIPs, for people with additional care and/or mobility needs. It is being kept for people under 16, but everyone else is gradually being moved across to PIPs.

- Attendance Allowance is for people aged 65 or over with serious care needs. It covers the additional costs, and is not means-tested or contribution-based.

- Carer’s Allowance can be paid to someone caring for an individual who receives PIPs (with daily living component), DLA (with higher or middle rate care component) or Attendance Allowance. They must spend at least 35 hours per week caring, and not earn more than £116 per week from work.

- I am in work, but not earning much. What help is available?

-

- You may be entitled to Working Tax Credits to top up your earnings. In order to qualify, you must be working enough hours per week:

- 30 hours if you are over 25 and none of the situations below applies,

- 24 hours between you if you are part of a couple with a dependent child (and one of you must work at least 16 hours per week),

- 16 hours if you are the lone parent of a dependent child,

- 16 hours if you are over 65,

- 16 hours in certain cases if you have a “disability which puts you at a disadvantage in getting a job”.

- Under 25s who do not fit into any of the above categories are generally not entitled to receive Working Tax Credit.

- People count as in full-time work for the first 39 weeks of maternity leave or while receiving Statutory Maternity Pay, Maternity Allowance or other parental pay. The same is also true while receiving ESA, Statutory Sick Pay or connected Income Support.

- If you stop working enough hours, you can continue to receive Working Tax Credit for the next four weeks.

- Alternatively, if you are working less than 16 hours per week earning very little, you might be entitled to apply for Jobseeker’s Allowance while looking for more work. See above for further details.

- If you meet certain conditions, you may be directed to apply for Universal Credit instead of Working Tax Credit or Jobseeker’s Allowance.

- I am unemployed. What help is available?

-

- The primary assistance for people who find themselves unemployed is Jobseeker’s Allowance (JSA). This acts as a replacement for earnings, and is either contribution-based (i.e. if you have recently been working) or means-tested. You will usually not be able to claim JSA if you are a full-time student or of pensionable age.

- be willing and able to work up to 40 hours per week,

- be able to start work immediately (or with a week’s notice if you have caring responsibilities or do voluntary work),

- actively seek work each week according to your agreement with the JobCentre,

- regularly “sign on” at the JobCentre and attend any interviews or other activities booked in for you.

- Failure to comply with the terms of the agreement with the JobCentre could lead to a sanction, which means that your benefit is suspended. The length of this suspension depends on the seriousness of the failure, and the number of previous sanctions received. The minimum suspension is usually four weeks.

- If you meet certain conditions, you may be directed to apply for Universal Credit (see below) instead of Jobseeker’s Allowance.

- Am I entitled to financial help when starting work?

-

- If you start work for 16 hours per week or more, you might be entitled to some financial support to help the transition from benefit to work. Depending on circumstances you might qualify for:

- Mortgage interest run-on

- Extended payments of housing and council tax benefit

- A job grant

- A payment from the Adviser Discretion Fun

- Return-to-work credit

- In-work credit.

- What is a Discretionary Housing Payment?

-

- Discretionary housing payments (DHP) are extra payments that can be made by your local authority if:

- You are entitled to Housing Benefit or Council Tax Benefit; and

- You require some financial assistance in addition to your normal entitlement to Housing Benefit or Council Tax Benefit to meet your housing costs (including council tax).

- You do not have a ‘right’ to DHP and there is no right of appeal to a First-tier Tribunal. You do have the right to ask the local authority to review their decision and you might be able to challenge a review decision by judicial review.

- What is a winter fuel payment?

-

- This is a lump sum payment if you are 60 or over in the qualifying week (usually the 3rd Monday in September) and you are ordinarily resident in Great Britain and, if a claim is required, you claim in time, and you are not excluded. For a list of exclusions, see www.cpag.org.uk

- What is a cold weather payment?

-

- Cold weather payments are payments made to people to to help with fuel costs during periods. You will qualify if:

- In the area where you live the temperature is recorded as, or forecast to be, zero degrees celsius or below for 7 consecutive days; AND

- you are not living in a care home or staying in hospital for a long time; AND

- you qualify for Universal Credit, Income Support, income-based Job Seekers allowance or income based Employment Support Allowance that includes a qualifying premium/component or you have a child under 5, or you are getting Pension Credit; AND

- you are not a person subject to immigration control

- It is paid automatically with your existing benefits - if you don't get it contact the jobs centre or for UC ring 0345 600 0723.

- What if I disagree with a decision by a benefits agency?

-

- For all benefits except Housing Benefit and Council Tax Support, the first step is to ask the benefits agency for a mandatory reconsideration. Details of how to do so should be on the decision notice, and you will usually have to do this within a month of the decision. Ideally you should make this request in writing, so that you have a record of it, but alternatively you can do so by telephone. If there is important evidence that has been missed, you should send copies to the agency (ideally by registered post).

- If the agency does not change its decision, then the next step is to appeal to an independent Tribunal. For decisions by the Department for Work and Pensions (e.g. JSA, ESA, Income Support, Pension Credit), you will need to use form SSCS1. For decisions by HMRC (e.g. Working Tax Credit, Child Tax Credit, Child Benefit) you will need to use form SSCS5. If you are thinking of going to the Tribunal, please get in touch as soon as possible, as we may be able to assist you.

- Can my claim for benefit be backdated?

-

- Depending on the benefit, your claim can sometimes be backdated for up to three months (12 months for retirement pension). You will have to ask for the claim to be backdated, otherwise it will not be considered. There are various conditions for backdating different benefits, so seek advice if you are unsure.

- How do I make a claim?

-

- Many benefits can now be claimed over the phone, with the completed or partially completed claim form being sent to you for checking and signing or you can complete a claim form on-line. Check how to claim by going to www.directgov.uk

- Does my immigration status affect my entitlement to welfare benefits?

-

- Yes it does. You will have full access to benefits if you are a national of the UK or the Common Travel Area (Ireland, the Channel Islands or the Isle of Man) or if you have indefinite leave to remain, permanent residence or another immigration status which gives recourse to public funds. Otherwise, your access to benefits depends on your status.

- Note that regardless of your immigration status (and even if you are a UK national), there are rules limiting your access to benefits if you have only recently arrived in the UK (for example, after an extended stay abroad).

- You can find a list of what counts as ‘public funds’ ( this is from gov.uk a government website)

- What benefits benefits am I entitled to?

-

- These FAQs contain a very brief introduction to the benefits available in different circumstances. There are also a number of online calculators that can help you assess your personal entitlement to benefits. The most comprehensive calculator is probably the one by Turn2Us.

- The Citizens Advice website has extensive information on welfare benefits, it is especially good as it is applicant/ claimant focused . You can also get further advice if needed by calling our advice line.

- Gov.uk has a good basic guidance especially on on eligibility criteria. This is a government website and is for information only ie there is little or no advice.

- What are welfare benefits?

-

- The welfare state of the United Kingdom comprises expenditures by the government of the United Kingdom intended to improve health, education, employment and social security.

- Welfare benefits are a form of government assistance for people in difficult circumstances. This can include: unemployment or low-paid employment, llness / disability, pregnancy or raising children, and/or difficulty paying rent or Council Tax.

- Some welfare benefits are “means-tested” which means that they are assessed based on your income and savings. Some are “contribution-based” which means that they are based on National Insurance contributions. Others (such as some disability benefits) are based on neither.

- Please note that your immigration status may affect your entitlement, and there are rules limiting your access to benefits if you have only recently arrived in the UK (for example, after an extended stay abroad).